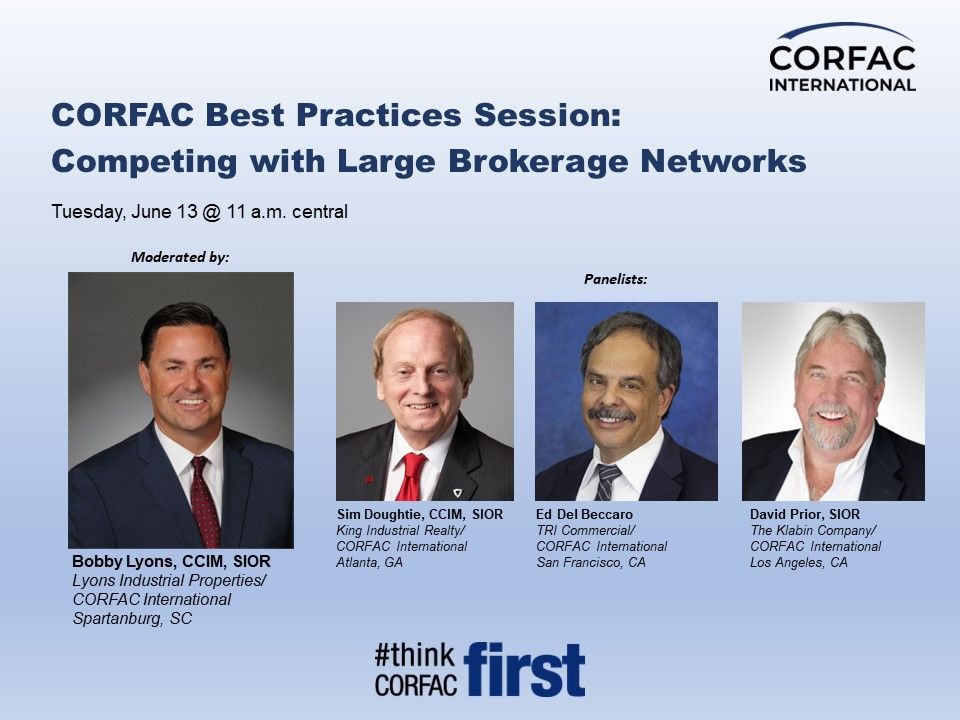

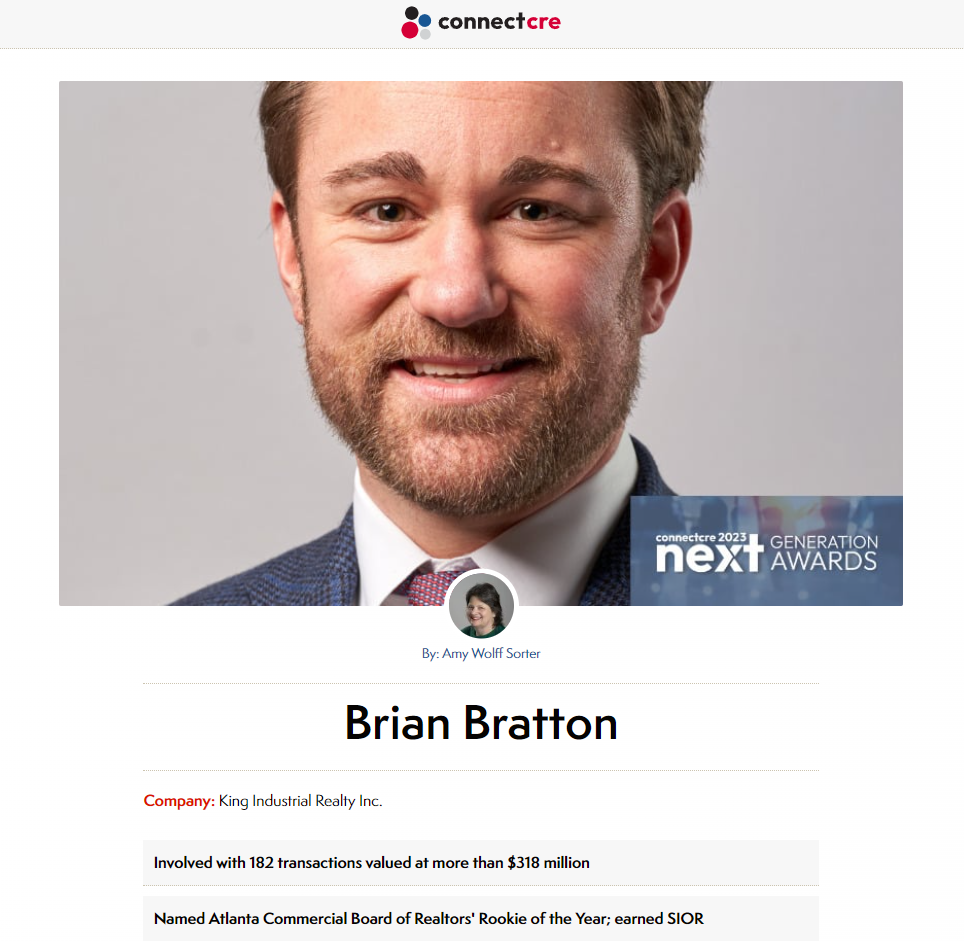

“Not unlike making sausage, a lot goes into completing a challenging industrial deal. It’s not always pretty, but with knowledge, determination and creativity, the end result can be incredible! We give the Sausage Maker of the Year award to the agent …

Read More